indiana excise tax alcohol

The primary excise taxes on tobacco in Indiana are on cigarettes though many states also have taxes on other tobacco products like cigars snuff or e-cigarettesThe tax on cigarettes is. An excise tax at the rate of two dollars and sixty-eight cents 268 a gallon is imposed upon the sale.

U S Wine Excise Tax Rates By State 2021 Statista

Alcohol Beverage Applications Forms.

. And for wine the pay an extra 47 cents. Have a State Excise Officer speak at my school or organization. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

Indiana Alcoholic Beverage Permit Numbers Section B. Alcohol and tobacco article 4. Add Line 6 amounts from all columns.

House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100. Indianas general sales tax of 7 also applies to the purchase of liquor. Revenue and taxes chapter 3.

Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. For more information about Alcohol excise taxes contact DORs Special Tax Division at excisetaxdoringov or 317-615-2710. The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana.

Attend a certified server training program in my area. Liquor excise tax download as pdf. The Indiana State Excise Police is the law.

For more information about the technical. Apply for employment as an Indiana State Excise Police officer. The Indiana State Excise Police is the law enforcement division of the Indiana Alcohol and Tobacco Commission.

Indiana Alcoholic Beverage Permit Numbers List the Indiana Alcoholic Beverage Permit Numbers obtained from the Indiana Alcohol and Tobacco Commission. The per-gallon rates are as follows. Gross Alcohol Tax Due.

Collection Allowance for Timely Payment. Alcohol and tobacco article 4. Indiana Alcoholic Beverage Permit Numbers Indicate the Indiana Alcoholic Beverage Permit Numbers obtained from the Indiana Alcohol and Tobacco Commission.

Revenue and taxes chapter 3. 2016 indiana code title 71. For taxable years beginning before January 1 2021 the tax is imposed at a rate of 14 on gross receipts from all utility services consumed within Indiana.

This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would. For beer they pay an extra 11 and one-half cents. Indiana Liquor Tax - 268 gallon.

Visit Electronic Filing for Alcohol Taxpayers for filing information. Liquor excise tax download as pdf. Multiply Line 5 by the tax rate in each column.

2015 indiana code title 71. State Excise police officers are empowered by statute to enforce the. In Indiana liquor vendors are responsible for paying a state excise tax of 268 per.

For more information about Alcohol excise taxes contact DORs Special Tax Division at excisetaxdoringov or 317-615-2710. The Indiana Alcohol and Tobacco Commission ATC is happy to provide guidance and direction on the process for submitting applications and. The paper forms with instructions shown below are available so customers can visualize what is required.

But if the wine has.

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

How Alcohol Taxes Figure Into Your Margarita Day Celebration Don T Mess With Taxes

Monthly Report Of Excise Tax For Alcohol Beverages Dr 0442 Pdf Fpdf Doc

Vintage Shenley Alcohol Bottle With Indiana Excise Tax Stamp Ebay

Indiana Liquor Control Information Alcoholic Beverage Commission Laws

Vintage Old Quaker Rye Whiskey Bottle With Label And Indiana Excise Tax Stamp Ebay

Alcohol And Tobacco Tax And Trade Bureau Wikipedia

Alcohol Sales In Indiana And New Liquor Legislation Overproof

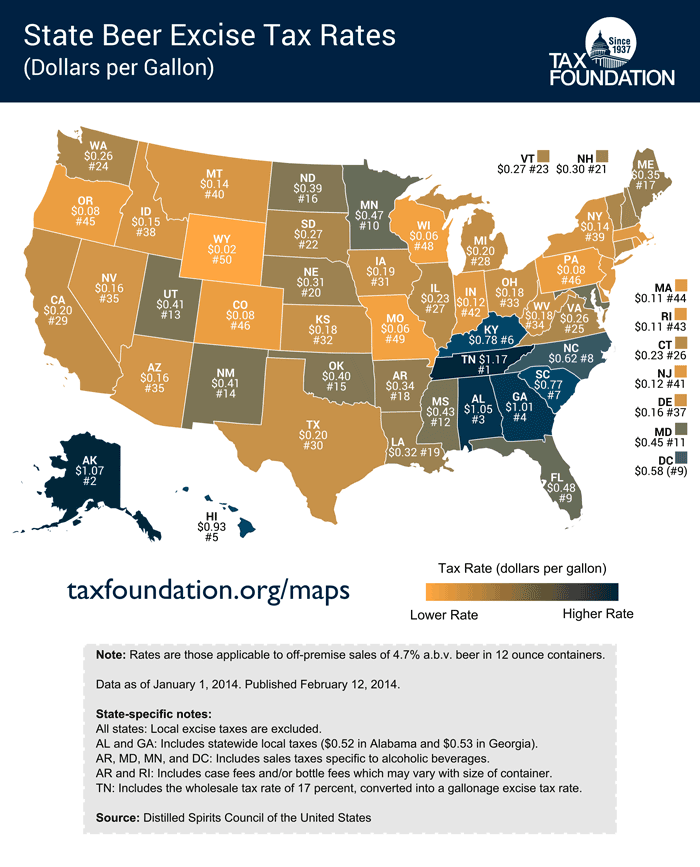

Alcohol Taxes On Beer Wine Spirits Federal State

Taxes Comparing Cannabis With Alcohol Cannabis Business Times

How Alcohol Importers Are Losing Out On Excise Tax Benefits Sevenfifty Daily

Governments Dip Deeper Into Alcohol Tax Well

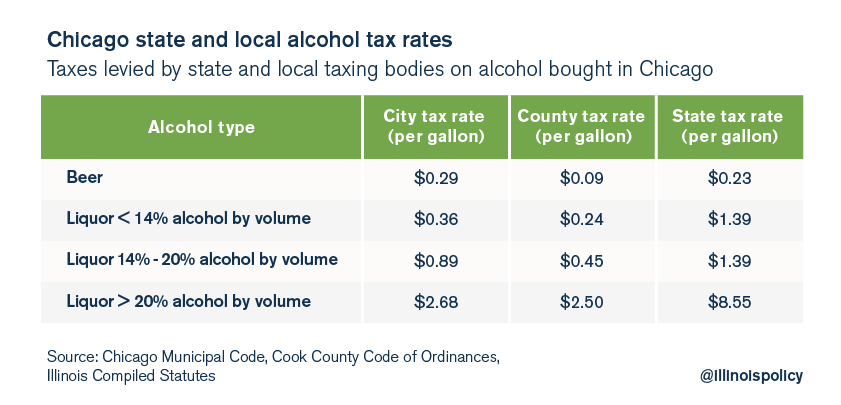

Chicago S Total Effective Tax Rate On Liquor Is 28

Taxes Comparing Cannabis With Alcohol Cannabis Business Times

Michigan Alcohol Taxes Liquor Wine And Beer Taxes For 2022