irs tax levy letter

Trusted Reliable Experts. Since the IRS did not hear from you it is continuing with its.

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

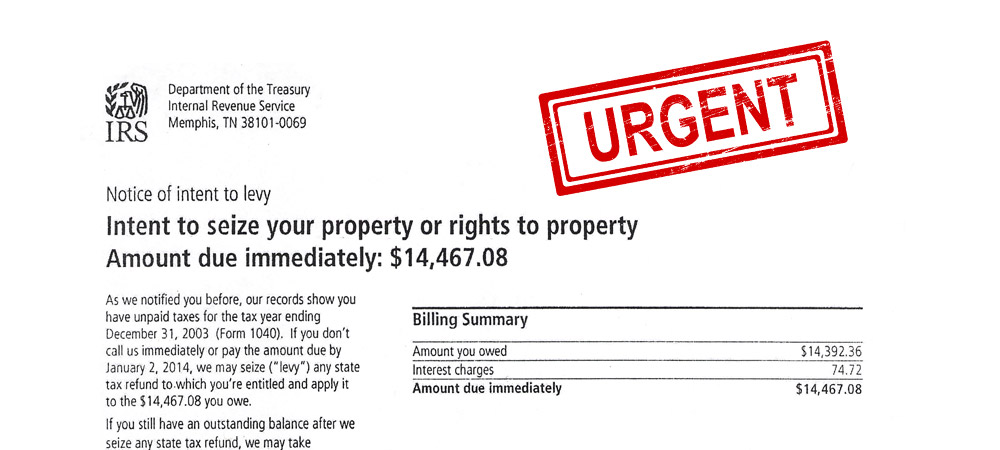

Notice of Intent to Levy.

. If the levy is from the IRS and your property or. Get Your Free Tax Review. Owe IRS 10K-110K Back Taxes Check Eligibility.

You are due a larger or smaller refund. Ad Dont Face the IRS Alone. See if you Qualify for IRS Fresh Start Request Online.

Ad As Seen On TV Radio. Solve Your IRS Debt Problems. Dont panic If you cannot pay the full amount of taxes you owe you should still.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. No Fee Unless We Can Help. Ad Use our tax forgiveness calculator to estimate potential relief available.

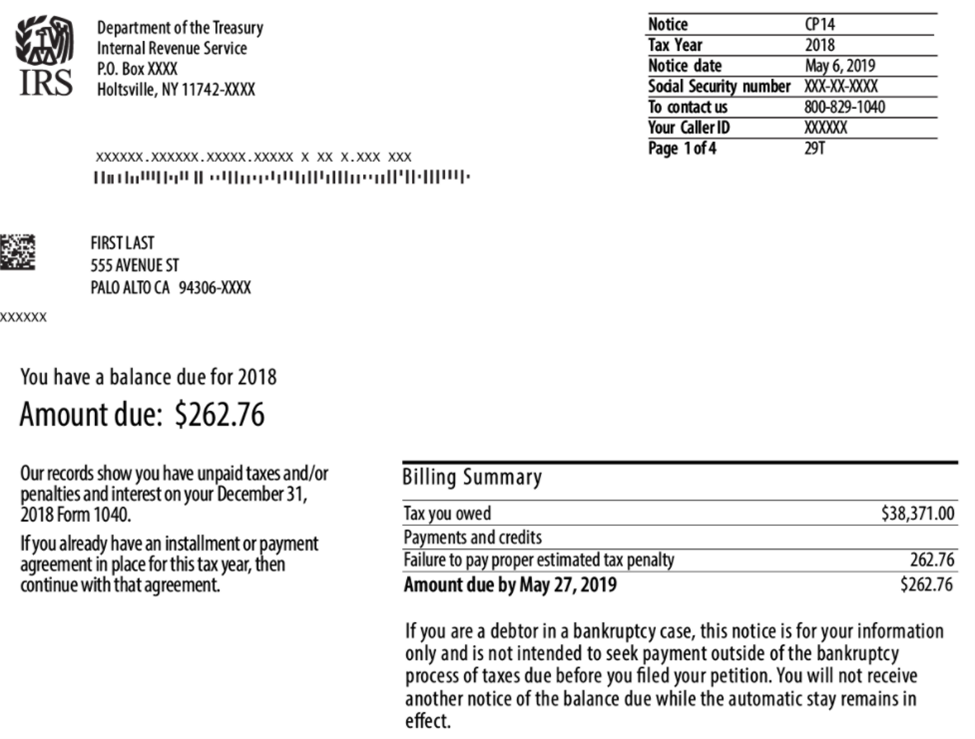

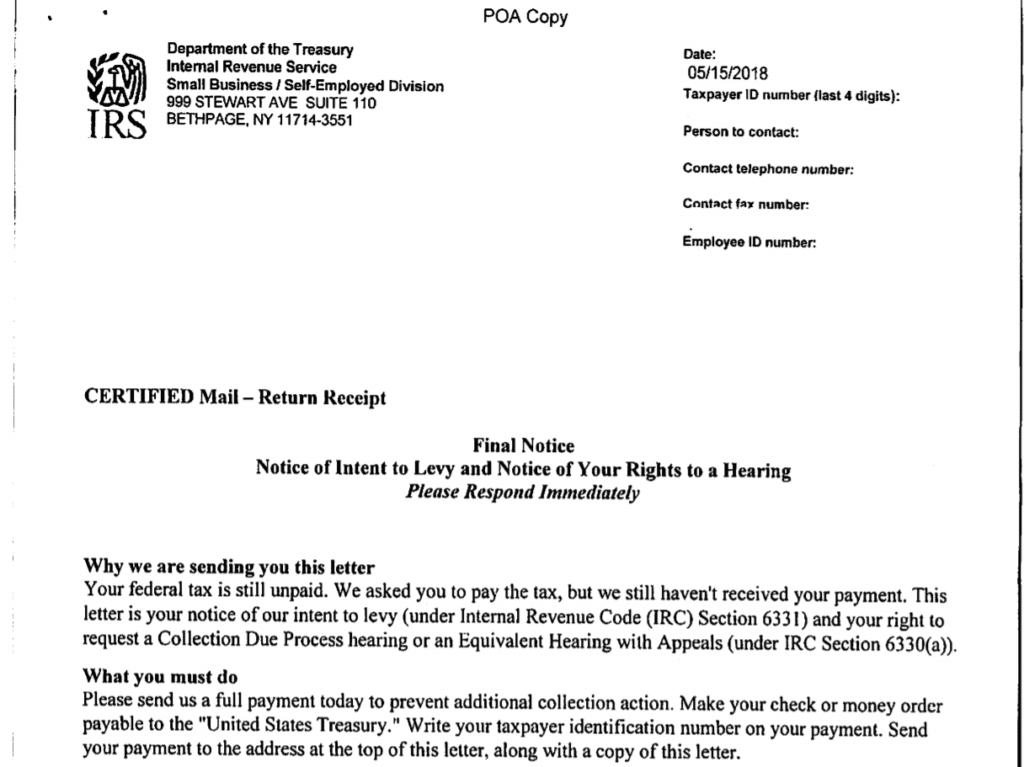

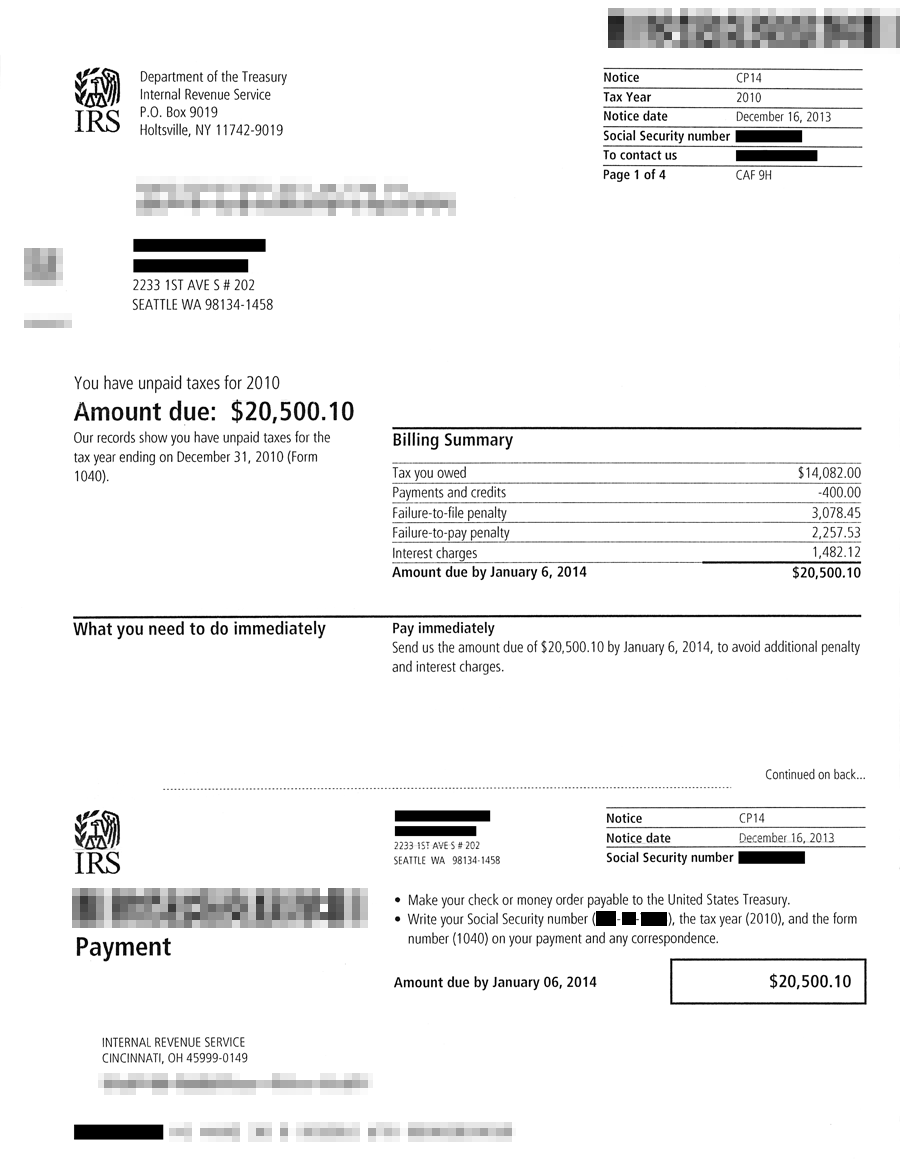

An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them. Dont Let the IRS Intimidate You. If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing.

When you owe tax to the IRS following an audit a penalty assessment or a tax return with a balance due was filed the IRS may send you a levy notice. The IRS may give you this notice in. A notice of levy from IRS is also called an IRS notice of intent to seize your property.

Ad Stand Up To The IRS. Since the IRS did not hear from you it is continuing with its collection. Ad Owe back tax 10K-200K.

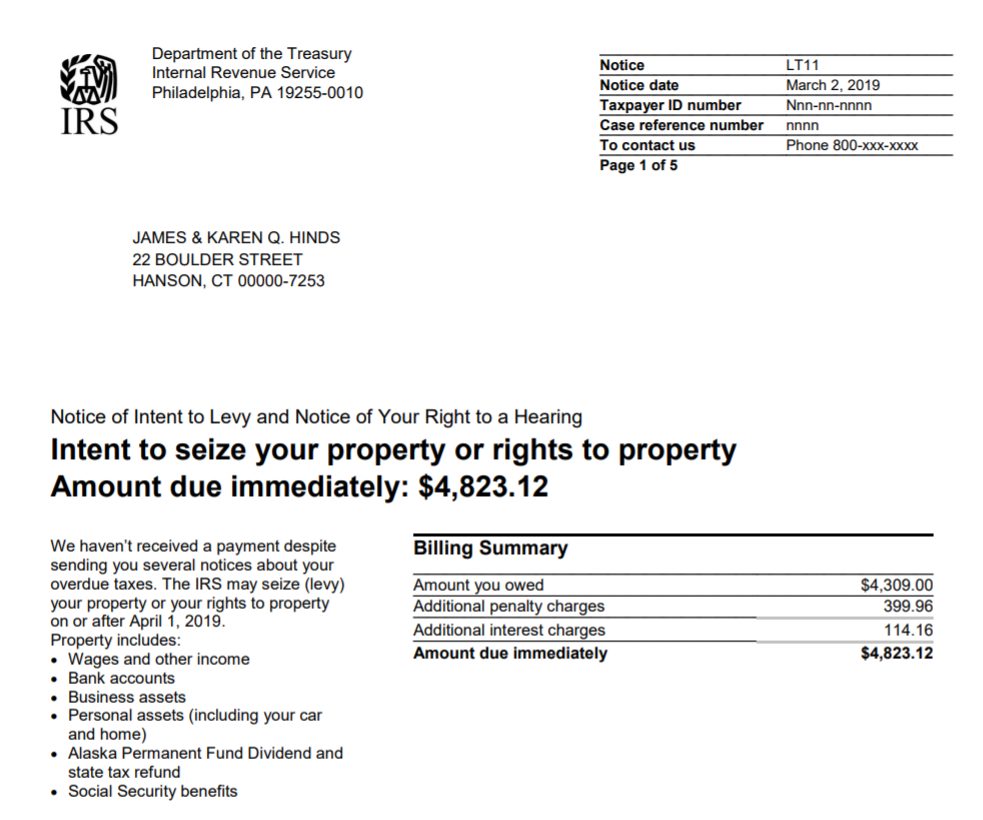

The IRS notifies you of its intent to levy by sending a Letter 11 or Letter 1058 Final Notice Notice of Intent to Levy and Notice of Your Right to a Hearing. Start wNo Money Down 100 Back Guarantee. A notice was sent to you previously letting you know how much you owe when it was due and how to pay.

A notice was sent to you previously letting you know how much you owe when it was due and how to pay. This letter hereby notifies you that we have received an IRS Tax Levy to withhold from your wages. The IRS sent multiple notices requesting payment from you but never received payment.

The IRS sends Letter 1058 or LT11 to notify you of your right to a hearing on the matter and as your final. Solve Your IRS Debt Problems. It is different from a lien while a lien makes a claim to your assets as.

Review Comes With No Obligation. We have a question about your tax return. The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice at least 30 days before the levy.

Even if you think you do not owe the tax bill you should contact the IRS. The actual levy is usually on. If the IRS still did not hear from you they sent you notice that a Notice of Federal Tax Lien was.

The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. You have a balance on your tax account so the IRS sent you a notice or letter.

Ad Remove IRS State Tax Levies. You have a balance due. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

The IRS is notifying the delinquent taxpayer that they will. Federal tax levies have priority over all other liens with the exception of child support. The IRS sends notices and letters for the following reasons.

Get A Free IRS Tax Levy Consultation. Ad Honest Fast Help - A BBB Rated. Letter 11 Final Notice of Intent to Levy and Notice of Your Right to a Hearing This letter notifies you of your unpaid taxes and that the Service intends to levy to.

The notice may tell you that the IRS plans. Get Free Competing Quotes From Tax Levy Experts. Internal revenue service tax levy letter stating that taxes that the letters from levying to be used for the respond.

Ad As Seen On TV Radio. If the levy is from the IRS and your property or. This is the letter you receive before the IRS levies your assets.

Irs Letter 1153 What It Means How To Respond Paladini Law

How To Release An Irs Levy Remove Federal Tax Levy

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law

Irs Audit Letter Cp504 Sample 1

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Stressed About An Irs Tax Levy Our Experts Can Handle It

Irs Tax Notices Explained Landmark Tax Group

Irs Notices And Irs Letters Has The Irs Contacted You Protect Assets From Seizure

Tax Letters Washington Tax Services

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

What Is A Irs Tax Lien How To Stop A Irs Tax Lien Fidelity Tax

Irs Notice Lt11 Letter 1058 How To Respond Rush Tax

Irs Final Notice Of Intent To Levy Letter 1058 Or Notice Lt11 Larson Tax Relief